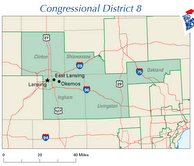

As the representative for Michigan's 8th congressional district, Mike Rogers is supposed to work for you. Trouble is, he also works for quite a few Political Action Committees, to the tune of over $662k during the 2005-2006 campaign cycle, in fact.

So, who were some of the PAC's that Mike Rogers accepted campaign contributions from this year? Well, for starters, he took money from Altria Group (formerly Philip Morris), telecos like AT&T, and

Of course, these days, it's not exactly a shock to learn that corporations from the tobacco, telecom, and defense industries are funding republican camapaigns. Still, when Mike Rogers says he works "for you," it's a little misleading -- his constituents clearly aren't the only people he works for.

A perfect example is the "Bankruptcy Abuse Prevention and Consumer Protection Act" of 2005. Here's a little background on the Bankruptcy bill [from TPM]:

...the credit card companies are the driving force behind this legislation. Some in the Senate recognize this.

The bill is more than 500 pages long, all in highly technical language. But the overall thrust is pretty clear:

• Make debtors pay more to creditors, both in bankruptcy and after bankruptcy, so that a bankruptcy filing will leave a family with more credit card debt, higher car loans, more owed to their banks and to payday lenders.

• Make it more expensive to file for bankruptcy by driving up lawyers’ fees with new paperwork, new affidavits, and new liability for lawyers, so that the people in the most trouble can’t afford to file.

• Make more hurdles and traps, with deadlines that a judge cannot waive even if someone has a heart attack or an ex-husband who won’t give up a copy of the tax returns, so that more people will get pushed out of bankruptcy with no discharge.

• Make it harder to repay debts in Chapter 13 by increasing the payments necessary to confirm in a repayment plan, so that more people will be pushed out of bankruptcy without ever getting a discharge of debt.

There are people who abuse the system, but this bill lets them off. Millionaires will still be welcome to use the unlimited homestead exemption. And if they don’t want to buy a home there, they can just tuck their millions of dollars into a trust, a “millionaire’s loophole” that lets them keep everything—if they can afford a smart, high-priced lawyer.

As you can see, this piece of legislation wasn't exactly consumer-friendly. And yet, Mike Rogers -- who received $37,398 from commercial banks and $9,324 from finance/credit companies -- voted for the bankruptcy bill.

Consumers in Michigan are starting to feel the pinch:

More than a year after provisions of the Bankruptcy Reform Act took effect in October 2005, debtors are finding it more expensive and time-consuming to file for bankruptcy protection, said John Pottow, U-M Law professor. The act, however, has not solved consumer financial distress.

"Reform, as it was styled, focused on reducing the number of bankruptcies but paid no attention to their cause," said Pottow, a bankruptcy expert. "The data we see suggest the underlying cause is getting worse: a growing number of Americans still cannot pay their debts."

Debts are likely to increase during the holidays. Consumers rely heavily on credit cards to buy gifts, decorations and other related items, then get debt-induced hangovers in January when they go to their mailboxes to find much higher than expected credit card bills.

If debtors consider filing for bankruptcy protection, they can expect higher costs. Pottow said reports suggest attorneys fees have jumped by 50 to 100 percent in response to the complexity of the new law.

Merry Christmas, 8th District!

Here's the problem. It's impossible for us to know with any certainty who/what is truly influencing Mike Rogers' decisionmaking as a legislator, since he's taken so much money -- over $3 million -- from so many different PACs during his career.

Sure, you'd be hard pressed to find a representative from either party in Washington who hasn't taken money from a PAC during their career, but Mike Rogers isn't just any congressman. He's our congressman, and when he says that he works for us, he's clearly not telling the whole story.

Needless to say, we'll be comparing Mike Rogers' voting record during the 110th Congress with his campaign contributions from the 2005-2006 campaign cycle. Stay tuned...

(Cross-posted on Pohlitics, MichiganLiberal, and DailyKos)

1 comment:

Citibank charging 31.43% interest AND $39.00 late fee.

I discovered the fraudulant use of one of my credit cards when I ordered a copy of my credit report.

The monthly statements were being sent to a fraudulant address.

It is all resolved now, but I saw what these banks can get away with when I received copies of the monthly statements ... highway robbery.

Post a Comment